It’s all about the digital scarcity

Bitcoin is the first and only digital object that is both quantifiably scarce and provably secure. This makes Bitcoin the next logical evolution in money… it’s just better money.

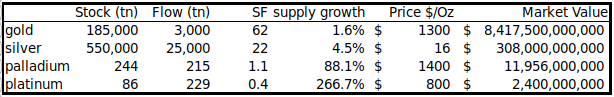

In the world of commodities, there is a spilt between monetary assets, those with a high stock-to-flow (SF) ratio, and standard commodities which have value because of their utility (e.g. oil) [1].

This matters because Bitcoin is simply digital gold, it is just the newest monetary asset. Gold, Silver, and other monetary assets like Bitcoin have SF ratios meaningfully above 1.

In Q2 of 2019 Bitcoin had a stock of 17.5M and a flow of about 700,000 bitcoins per year. This means Bitcoin has a Stock-to-Flow (SF) of 25 in May 2019. This puts it squarely into the monetary category, above silver and below gold.

Once Every Four Years

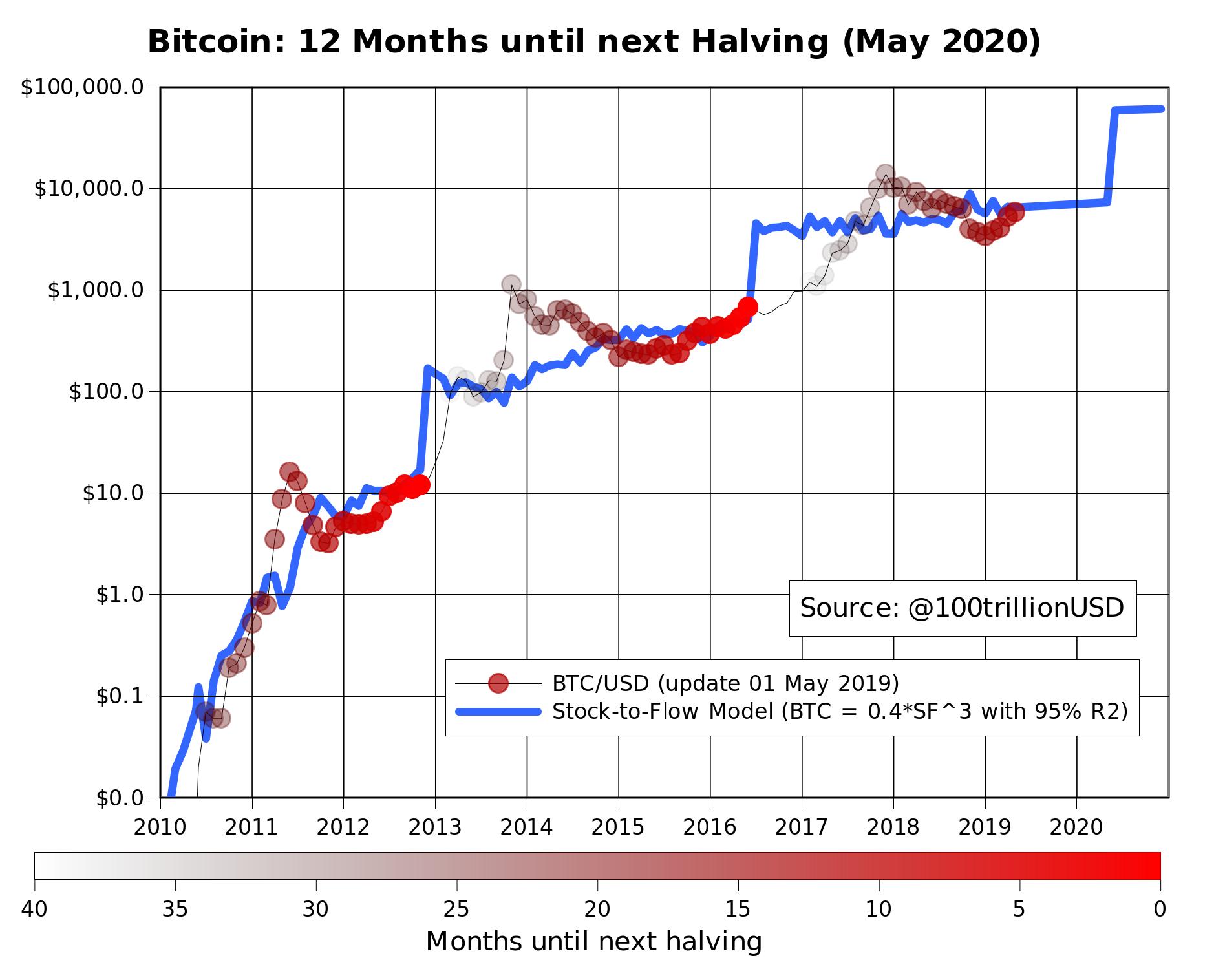

There is a halving where the number of bitcoins mined annually diminishes by half [2]. What you notice is that these halvings double the stock-to-flow (SF) ratio of Bitcoin. This is important because it looks like there are correlations between SF and price. In May 2020, Bitcoin will undergo the third of its quadrennial halvings, doubling Bitcoins SF to 50.

Money is important

Not merely for its financial implications, but also, because just like language, money is essential to good human cooperation. Better money leads to better cooperation. And money is just a technology. It can be improved upon. And Bitcoin is the most recent improvement on the concept of money. Gold has gone digital; it’s called Bitcoin [3].

Bitcoin is a real piece of art, it's deep, it's fundamental and yet simple…

[1] The Bitcoin Standard – Saifedean Ammous (@saifedean)

[2] Bitcoin: A Peer-to-Peer Electronic Cash System – Satoshi Nakamoto

[3] Modeling Bitcoin's Value with Scarcity – PlanB (@100trillionUSD)